Course Information

Basic Information

The first IP Valuation Certificate Program was successfully presented in Paris, France, from March to June 2023. The second session of the IP Valuation Certificate Program is in process in Manila.

Course Dates

Next sessions will be held in Manila (Philippines), the dates are still under discussion. The final exam will be in November 2025.

Other sessions will be programmed in Europe and other countries.

It is possible to register until one week before the start of the session.

Course Location

The next session of training will take place in Manila (Philippines).

Other sessions are discussed.

The course locations will be accessible to people with disabilities.

Cost

The full program costs for Europe is € 8100, and for Philippines 150 000 PHP, which includes:

- access to self-training online modules as needed for the candidates to prepare themselves

- tuition fees, lunch and coffee for the 3 course blocks of 3 days each

- 1 x exam

- 1 x IP valuation report evaluation

- membership in partnering organizations when applicable

Payments: 30% on registration, 70% on completion of first block.

Prerequisites

- To be able to fully benefit from the training you need to be fluent in English.

- Even if it is not required to be an intellectual property expert, having a general knowledge of the matter will help you during the training.

Performance indicators

During the training, the success rate, the drop-out rate and the satisfaction of the trainees are measured and used as indicators for progress.

Success rate: 89%

Drop-out rate: 0%

Partners

Royalty Range’s Royalty Database is used for training as part of the IPVC Course.

LES France is our local partner for the inaugural IP Valuation Certificate Course in Paris, France.

Detailed Curriculum

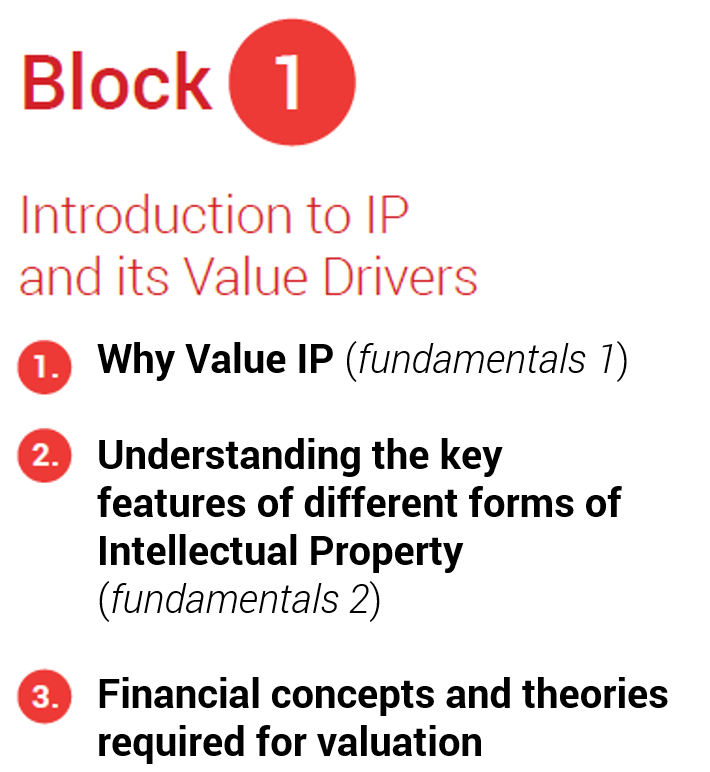

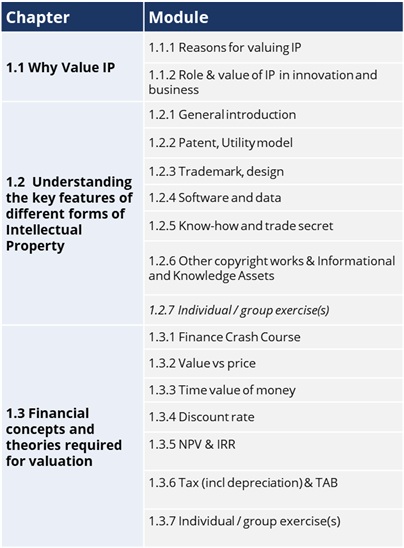

Block 1

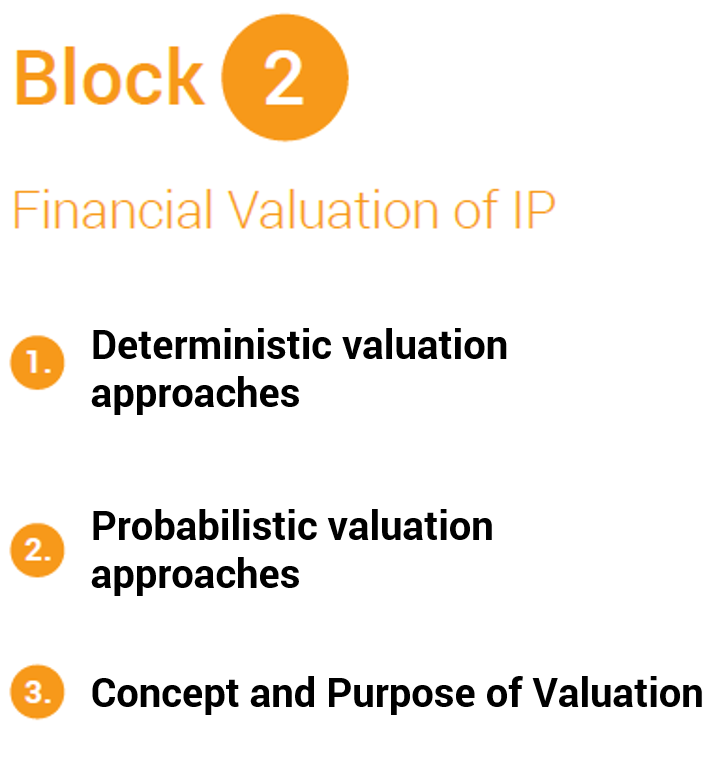

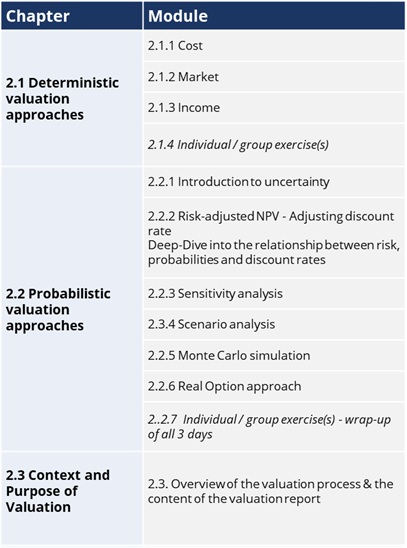

Block 2

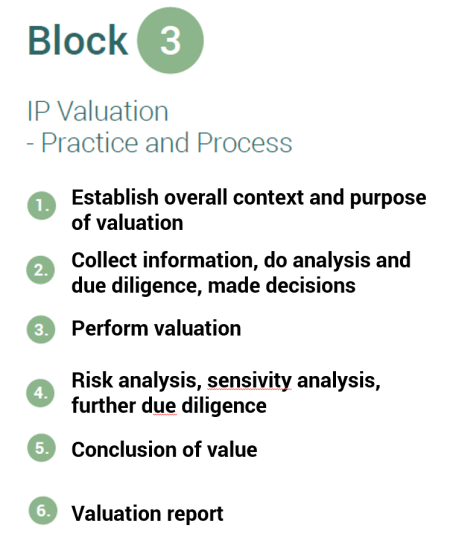

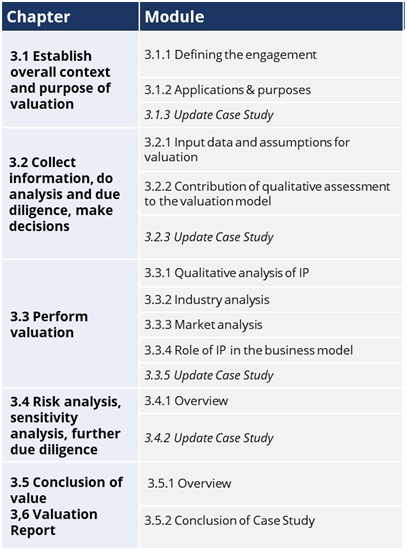

Block 3

Course outcomes

The program will allow you to acquire and master the following abilities:

- To explain, after detailed exchanges with the client, the reason(s) to value the IP asset, and determine the correct investigation approach.

- Define the contractual engagement with the client.

- Determine the way the IP asset contributes to the company in terms of strategy and value creation in order to determine:

- The correct method(s) for the valuation of the asset at stake.

- The key elements affecting its economic value.

- Master the economical and corporate finance concepts required to evaluate an intangible asset and use them on purpose

- Master the three deterministic intangible assets valuation methods on purpose to guarantee the possibility to defend the result(s) in front of any audience

- Correctly and rigorously implement all the steps of the IP Valuation process to guarantee the relevance of the final result.